If you know about Binance in Kenya, then this is the article for you. If not, don’t worry — we’ve linked plenty of resources to help you get up to speed with what we’re about to discuss: Binance Futures.

In this guide, I’ll walk you through Binance Futures, explain how it works, and show you how you can make Kshs 1,000 (that’s less than $8) a day by trading.

What is Binance?

Let’s start with a quick refresher. What exactly is Binance?

Binance is one of the largest and most well-known crypto exchange platforms in Kenya, and the world. It allows you to trade, invest, and make money from digital assets like Bitcoin, Ethereum, and more.

Binance stands out from other crypto exchanges for several reasons:

-

Lower trading fees compared to many other platforms

-

A large user base, which ensures liquidity

-

Binance P2P for easy buying and selling using local currency

-

Fast deposits and withdrawals

-

A wide variety of trading pairs available for investors and traders

To get a better understanding, read our full Binance review and get started. If you’re new to crypto in Kenya, check out our guide to starting crypto trading for more information.

Introduction to Binance Futures Trading

Now let’s dive into Binance Futures. Futures trading on Binance is one of the many ways to earn money with your crypto assets. But what exactly is it?

Futures trading allows you to buy or sell assets like Bitcoin or Solana at a set price for a future date, without actually owning the assets. Traders can take long positions (if they think prices will rise) or short positions (if they believe prices will fall).

In simpler terms:

-

If you think the price of a coin will rise, you go long.

-

If you think the price will fall, you go short.

-

If you’re unsure, you can take a neutral position and trade based on sideways market movement.

When you open a long position and the price increases, you make a profit. On the flip side, if your prediction is wrong and the price moves against you, you could lose money.

How to Trade Futures on Binance

Let’s get technical! But before we do that, you need to meet a few prerequisites:

-

Have a verified Binance wallet

-

Load your wallet with capital (We’ll get into funding your wallet in a moment)

-

Transfer funds from your Funding Wallet to your Futures Wallet

If you’re not sure how to verify and deposit funds into your Binance account, check out our previous Binance in Kenya article

Here’s how to transfer your funds to your Futures Wallet:

-

On your Binance app or website, go to your profile icon.

-

Click on Assets and then Overview to view your balance.

-

Tap on Transfer, select From Funding to USD-M Futures (for USD pairs).

-

Enter the amount you want to transfer and hit Confirm.

The transfer is instantaneous, and now you’re ready to start trading futures!

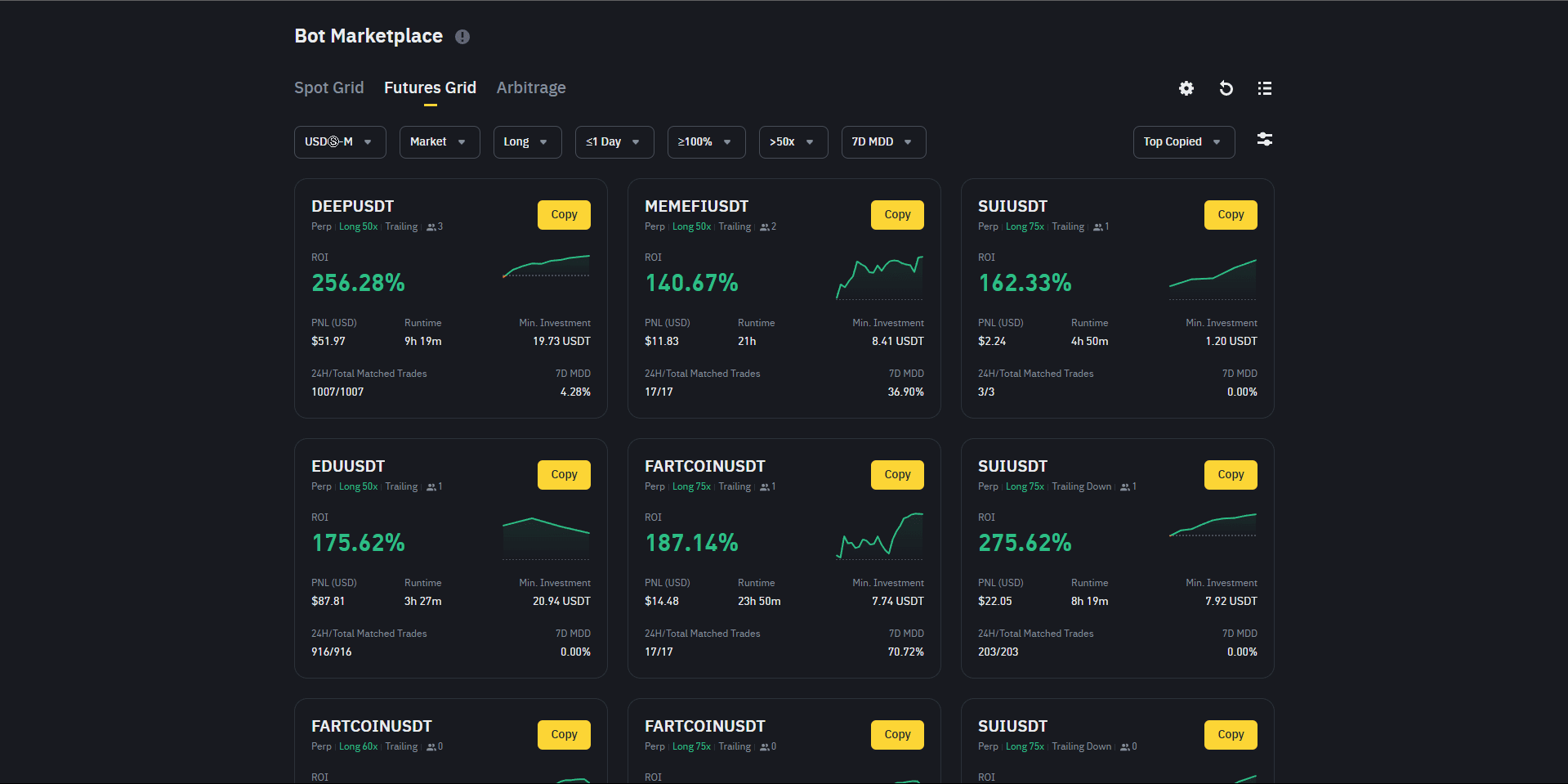

Factors to Consider When Choosing a Futures Bot on Binance

Futures trading is not a simple “buy and sell” process. Without the right analysis and strategy, you can lose your entire capital in minutes. So, when choosing trading pairs, here are the factors to consider:

Trade Type: Long, Short, or Neutral?

Long

When you go long, you’re buying an asset with the expectation that its price will increase. In simple terms, you’re betting that the value of the asset will rise. For example, if you believe that the price of Bitcoin will increase from $30,000 to $35,000, you would go long by buying Bitcoin at $30,000. Once the price hits $35,000, you sell the Bitcoin for a profit. This strategy works well when the market is trending upwards, and you expect the asset to appreciate in value.

Short

When you go short, you’re selling an asset that you don’t own, with the expectation that its price will fall. Essentially, you are betting against the market. To do this, you borrow the asset, sell it at the current market price, and wait for the price to drop. Once the price decreases, you buy the asset back at the lower price, return it to the lender, and keep the difference as profit. For example, if you think the price of Ethereum will drop from $2,000 to $1,800, you would go short by borrowing and selling Ethereum at $2,000. If the price drops to $1,800, you buy it back and make a profit of $200.

Neutral

When you’re neutral, you don’t have a specific view on the direction of the market. You do not expect the asset to go up or down significantly. Traders who adopt a neutral stance typically use strategies to profit from smaller price movements or market conditions where the price fluctuates within a range. For instance, some traders use options strategies like straddles, where they buy both call and put options to profit from price movements in either direction.

Leverage

Leverage is one of the most important aspects of futures trading. It allows you to control a larger amount of an asset than you could with just your own capital. Essentially, leverage amplifies both profits and losses.

For example, if you have $100 and use 10x leverage, you can control $1,000 worth of an asset, meaning a small price change can lead to larger profits. However, this also means that the risk of loss is greater. If the price increases by 10%, your $100 investment could make you $100 profit. But if the price drops by 10%, you’ll lose $100 instead of just $10.

When using leverage, Binance offers options from 1X-5X, 5X-10X, 10X-20X, 20X-50X, and greater than 50X. Be sure to check the leverage used by your chosen bot so you can make an informed decision.

How Long the Bot Has Been Running

The duration of a futures grid bot’s operation is important because it shows how much performance history is available for analysis. Bots that have been running for a longer period (e.g., several months) have had more time to adjust to market cycles, making them more reliable. Newer bots might still be testing strategies and could be riskier.

How to Choose the Right Futures Trading Strategy

Now that you understand the key factors, here’s how to make informed decisions when selecting a futures bot:

-

Filter bots: Sort bots by Top PnL, Leverage, ROI, and 7D MDD to suit your risk appetite.

-

Technical analysis: Once you’ve filtered through the bots, perform a technical analysis of the trading pair you’re interested in. Look for signs of uptrend, downtrend, or consolidation.

-

Set Stop Loss and Take Profit: Always adjust the bot’s parameters to match your trading goals. Be sure to include a Stop Loss and Take Profit to minimize risks.

-

Monitor the trade: After copying the bot’s trades, watch them closely to ensure everything is going according to plan.

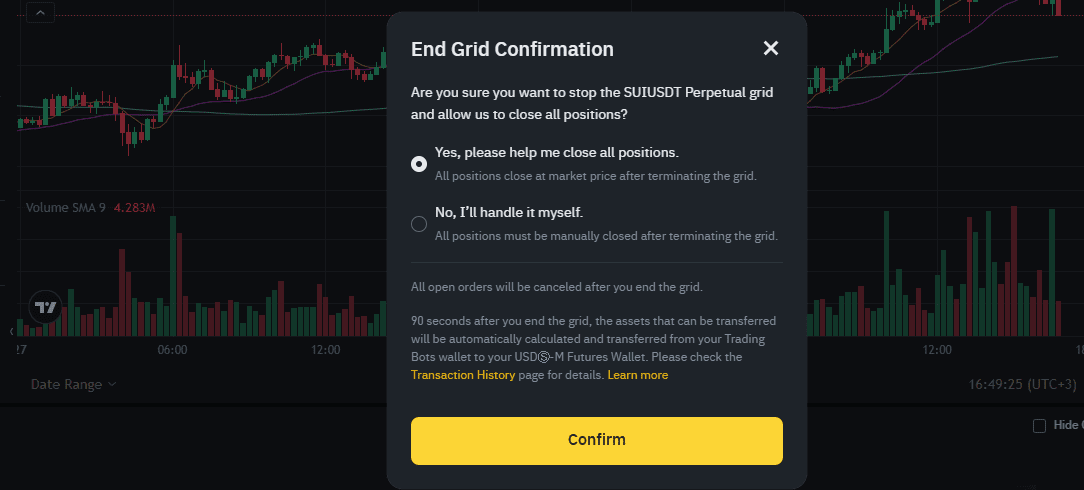

How to Stop a Futures Grid Bot

You can stop a futures grid bot in one of three ways:

-

Automatically using Take Profit or Stop Loss settings.

-

Manually by closing the positions yourself, either at market price or limit.

-

End the grid by letting Binance automatically close all trades once your conditions are met.

Each method has its advantages and disadvantages. Automatic settings are best if you’re new or want to walk away from the screen. If you’re more experienced, manual closing lets you control your trades more precisely.

Alternatives to Binance Futures

Binance Futures can be volatile and risky. If it’s not for you, consider spot trading, where you own the assets you trade. Spot trading doesn’t use leverage, making it safer for beginners. In future articles, we will cover spot trading in more detail but for now, lets have a quick overview;

Spot trading refers to buying and selling actual cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), or Solana (SOL), directly on the market. In spot trading, you own the cryptocurrency once you purchase it. Unlike futures, where you’re speculating on the price change without owning the asset, in spot trading, you’re trading real assets at current market prices.

For example, if you buy 1 BTC for $100,000 in the spot market, you own that Bitcoin, and you can choose to hold it, sell it, or transfer it to a wallet.

Conclusion

Learning how to trade Binance Futures can open doors to consistent income. It’s not easy, but with the right strategies, you can make Kshs 1,000 a day. With experience and discipline, you’ll become a skilled trader in no time.

If you’re new to futures trading, check out our crypto trading course to help you level up and become a pro trader in Kenya!