Introduction

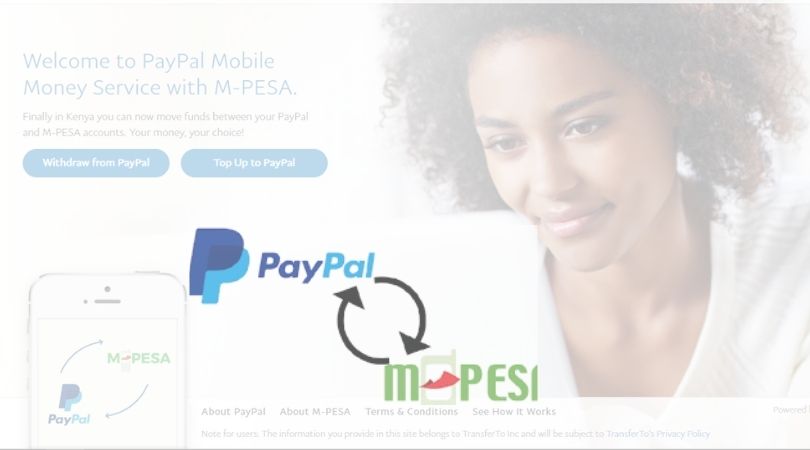

You have probably heard that M-Pesa is compatible with PayPal and you are probably wondering how to top up PayPal using M-Pesa. This is an ultimate guide to making sure that you deposit money from M-Pesa to PayPal.

Nowadays M-Pesa has progressed a lot. M-Pesa is now widely spread across Kenya, Tanzania, and South Africa. The growth of its popularity shows that more uses keep propping up as more and more companies want to partner with M-Pesa, and PayPal is now among the partners.

Some people claim that using the M-Pesa platform may be difficult. This is because of poor documentation provided by both companies and the lack of a user-friendly interface. If you probably among those who think that then this article is set to change your mind and show you just how easy it is to use both accounts together.

How to Top Up PayPal Using M-Pesa

To learn how to top up your PayPal using M-Pesa follow these very simple steps:

a. Register for both PayPal and M-Pesa online.

b. On your PayPal account deposit funds using the deposit button available at the top right of the page.

c. Select deposit through M-Pesa to continue.

d. Enter how much you are depositing into your PayPal account via Mobile Money service and click next to continue forward. A deposit slip will be generated showing all fund details on it.

e. Now visit an outlet where you deposit with Mobile Money service and deposit the agreed amount.

f. Now visit the PayPal deposit page once again, enter your Mobile Money i-PIN which is used for deposit and click continue to deposit.

g. Once you deposit successfully, you will receive an MTCN number from the agent which can be used to track the deposit. After several minutes of sending deposit confirmation through SMS, you will get another SMS if the deposit was successful or failed (depends on agents network failure sometimes)

h. Once the deposit has been completed through the Mobile Money service, visit the PayPal cash out tab and the request payment now button option to initiate the withdrawal request, and then you will get deposit confirmation mail in your PayPal email address shortly.

i. Deposit money from M-Pesa to PayPal takes 24 hours if a deposit is less than $50, for a deposit of more than $50 payments take 48 hours.

Note: The deposit slip can also be printed out if needed but is not required as long as you have another copy in case of being asked by an agent during the withdrawal stage.

You will also start seeing a pending transaction at your account within 1 minute of deposit successful notification via SMS or Email depending on your email settings in your PayPal account.

Pros and Cons of PayPal

| Pros | Cons |

| – Fast deposit and withdrawal compared to banks | – Deposits require a 24-hour authentication process |

| – No withdrawal limit | – PayPal users in Kenya are only allowed one account |

| – 2-factor authentication for increased security | – If your account is locked, support services are not that convenient |

| – User-friendly interface | |

| – Only 1% of transaction value is charged as fees |

Pros of PayPal

1) PayPal deposit and withdrawal is very fast as compared to other deposit methods available in Kenya like the ones provided by banks.

2) PayPal has no maximum withdrawal that its users are subjected to.

3) PayPal account gives its user a 2-factor authentication feature (since recently) as well as email confirmation before sending out any money via their account which serves as the 5th Star service security measure for their Kenyan customer.

4) PayPal deposit and withdrawal interface is user-friendly.

5) The deposit and withdrawal fees amount to 1% of the total transaction value for both deposit/withdrawal respectively. PayPal users are subjected to VAT in their deposit/withdrawal charges.

Cons of PayPal

1) Each deposit requires a 5-star authorization process which takes around 24 hours almost every time which inconveniences its users due to late payments for goods and services rendered.

2) PayPal account holders are only allowed one active account each in Kenya even though there are various email addresses that can be used as alternate verification methods.

3) Once your account is locked you have no customer support hotline and the only way to keep in touch with them is through the chat system. This can be frustrating.

PayPal Billing Agreement

Billing requirements refer to the deposit of funds as a deposit or withdrawal from PayPal. Any deposit made to your account from any source other than an approved Billing Agreement is a violation of PayPal’s User Agreement and will be subject to service fees outlined below.

As explained above, it requires a 5-star authorization process which takes 24 hours almost every time. All this means you receive late payments for goods/services rendered.

PayPal automatically deducts any unpaid or outstanding Commercial Transaction Fees at the time of deposit even though such transactions have not been marked as completed by either party (i.e., seller and buyer).

What to Consider with Your PayPal Billing Requirement?

PayPal’s billing requirements are as follows:

The name on the PayPal Account should match that of your bank account. The Billing Agreement can be signed at any M-Pesa shop but the deposit must happen from a designated deposit point only.

Also, deposits can be made at any time of the day but deposit times are restricted to certain hours like from 7 am to 11 pm. For an online deposit, you are required to put your account number in the Reference field and ensure it is exactly 12 digits as shown on your M-Pesa deposit receipt.

The deposit amount should be in multiples of Sh100 for online deposit. If you deposit more than once, then only one deposit will be valid and all other deposits will not process until after 24 hours.

PayPal charges a monthly 1% bank fee if the balance in their account is above $500, as an incentive for people to send money to their accounts. It also charges 0.35$ bank charge for every deposit made via credit card or PayPal transfers (deposits are free over 500 USD)

How to Set Up Your PayPal Billing Requirement

While learning how to top up PayPal using M-Pesa may prove vital in the end, so is billing when you are using PayPal for your business. To set up a billing requirement for your PayPal account you should follow the following steps:

i. Sign in to your PayPal account and go to the profile page.

ii. You will see a ‘Billing’ button on the top right side of your screen, click it.

iii. A few options are going to appear on the menu but just choose the ‘Manage PayPal Billing Agreement’ button

iv. You will be directed to a different page where you will be asked to fill a form.

v. Fill the form and confirm the details. You now have a billing requirement agreement on your page.

vi. If you do not agree with any of the pre-filled information, change it ASAP. Otherwise, the bank will inform PayPal that you refused to accept the bank charges, which could result in some action being taken against your account.

Is it Safe to Use PayPal?

While some people may believe that using PayPal is not safe, it’s actually the other way around. PayPal is a safe way to send and receive money. PayPal protects buyers against any fraudulent activity arising from transactions on its website.

PayPal ensures that the seller has positive feedback for at least 30 days prior to accepting payments through PayPal, this acts as an assurance for buyers.

Is PayPal Reliable?

The real answer to this question is quite disappointing because in as much as PayPal can be accessed with a wide region, it is not reliable. PayPal services in Africa have been suspended for a while now, and there is no indication when they will resume.

So there are some African merchants who don’t accept PayPal because of the unreliability of the service. This means that you can deposit money to your PayPal account but won’t be able to withdraw it immediately.

How safe is M-Pesa?

M-Pesa has been widely used by people in Kenya and Tanzania since 2007 with over 30 million users. The platform has grown so big that uses of the system have expanded beyond Kenya into more than seven countries including South Sudan, Uganda, Tanzania, and Zimbabwe among others.

The system eliminates the need for carrying cash around as individuals deposit money directly into their mobile phone accounts and also they can go ahead and use PayPal M-Pesa agents for this.

What Other Mobile Money Services Does PayPal Accept?

While mobile money systems are growing, PayPal so far accepts only M-Pesa as a mobile money payment method that it recognizes. In a recent update regarding PayPal’s mobile payment support, it was stated that the company does not currently accept other mobile money deposit methods or services such as MPESA from Safaricom in Kenya or EcoCash from Econet in Zimbabwe.

As far as the development to the story has been, PayPal M-Pesa services were however taken care of by the company and are currently still working.

Consumers who deposit through these platforms will have their funds reimbursed by PayPal. They are then required to resubmit new deposit information via an alternate deposit method acceptable by the company.

WANT A CHANCE TO MAKE SOME EXTRA CASH? HERE ARE SOME HELPFUL QUICK LINKS FOR YOU!

💡 Start your own blog with blue host for ONLY $2.95/Month – Free Domain offered

💡 Start generating content faster using Copy Writing AI aka Jarvis

💡 Start proofreading for money [Get paid up to 5$/Word]

💡Learn NEW and Exciting skills on skillshare and start making (Tons of small courses)!!

⭐Get alternative course platform with dirt-cheap courses. Sign up on Udemy

⭐Start earning from doing surveys on Swagbucks

⭐Start buying and selling bitcoin from the comfort of your home with Paxful

⭐Start trading forex with these 7 Kenyan regulated forex brokers

Final Take

Learning how to top up PayPal using M-Pesa will prove to be vital. For Kenyan traders dealing with international clients, PayPal services have proven to be very essential. They have allowed traders to trade in both sectors easily while their money remained as safe as could be. There has even been the rise of PayPal M-Pesa agents.

If you have been wondering if PayPal is worth all the hype around it, now you know. Nothing is ever perfect, but in the world of regional trades between people and companies, PayPal still remains a monster in allowing the trades to take place no matter the currency.