The cryptocurrency landscape in Kenya has evolved dramatically over the past few years, with more Kenyans seeking alternative income streams in the digital economy. While many focus on volatile day trading or long-term holding strategies, there’s a more stable approach that’s gaining traction among savvy Kenyan traders: peer-to-peer (P2P) trading.

In our previous blog, we shared strategies for making 2,000 shillings daily using Binance Futures. Today, I’m excited to reveal how you can earn even more – approximately 3,000 KES per day – through Binance P2P marketplace. This method has proven effective not just for me personally, but has helped many youths in Kenya generate consistent daily income with relatively low risk.

The beauty of P2P trading lies in its accessibility and reduced exposure to market volatility. Unlike traditional crypto trading where profits depend entirely on price movements, P2P trading allows you to profit from the spread between buy and sell prices. This approach is particularly valuable in Kenya’s growing crypto economy, where many people are looking for reliable ways to convert between cryptocurrency and Kenyan Shillings using familiar payment methods like M-Pesa.

Before we dive into the details, it’s important to understand that while P2P trading offers excellent income potential, it also requires dedication, attention to detail, and careful risk management. This isn’t a “get-rich-quick” scheme, but rather a methodical approach to generating consistent income through small, frequent profits. With the right strategy and discipline, achieving 3,000 KES daily is certainly within reach for most traders willing to learn the system.

What is P2P Trading?

Peer-to-peer (P2P) trading allows you to buy and sell cryptocurrencies directly with other users using local payment methods like M-Pesa. Unlike regular exchange trading, P2P lets you set your own prices and trade with fellow Kenyans using familiar payment methods. The platform essentially connects buyers and sellers, allowing them to trade directly without Binance acting as an intermediary for the actual transaction.

The Profit Opportunity

The key to making money with P2P trading is understanding and exploiting price differences between buyers and sellers on the platform. This concept, known as arbitrage, is remarkably simple yet effective:

- Buy cryptocurrency from sellers offering lower prices

- Immediately sell to buyers willing to pay higher prices

- Pocket the difference as your profit

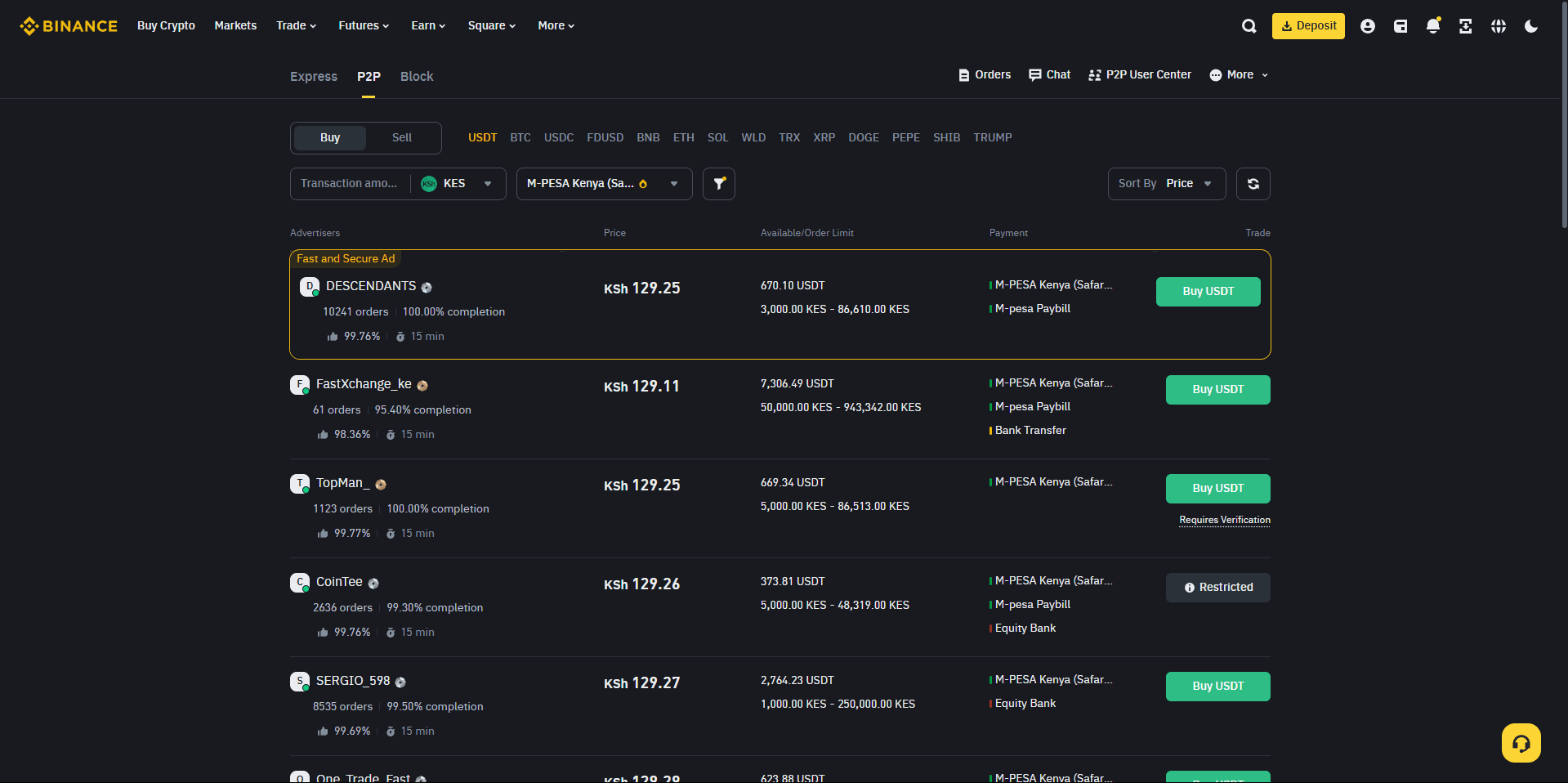

For example, at the time of writing this blog, I found users buying Ethereum at 220,000 KES while others were selling at 219,000 KES. By buying at the lower price and selling at the higher one, you could make a quick 1000 KES profit per Ethereum traded. These small margins add up significantly when you complete multiple trades throughout the day.

In some cases, you might find even larger spreads. I’ve seen instances where traders were able to buy at one price and sell at another with a 5,000 KES difference per Ethereum. The key is constantly monitoring the marketplace to identify these opportunities.

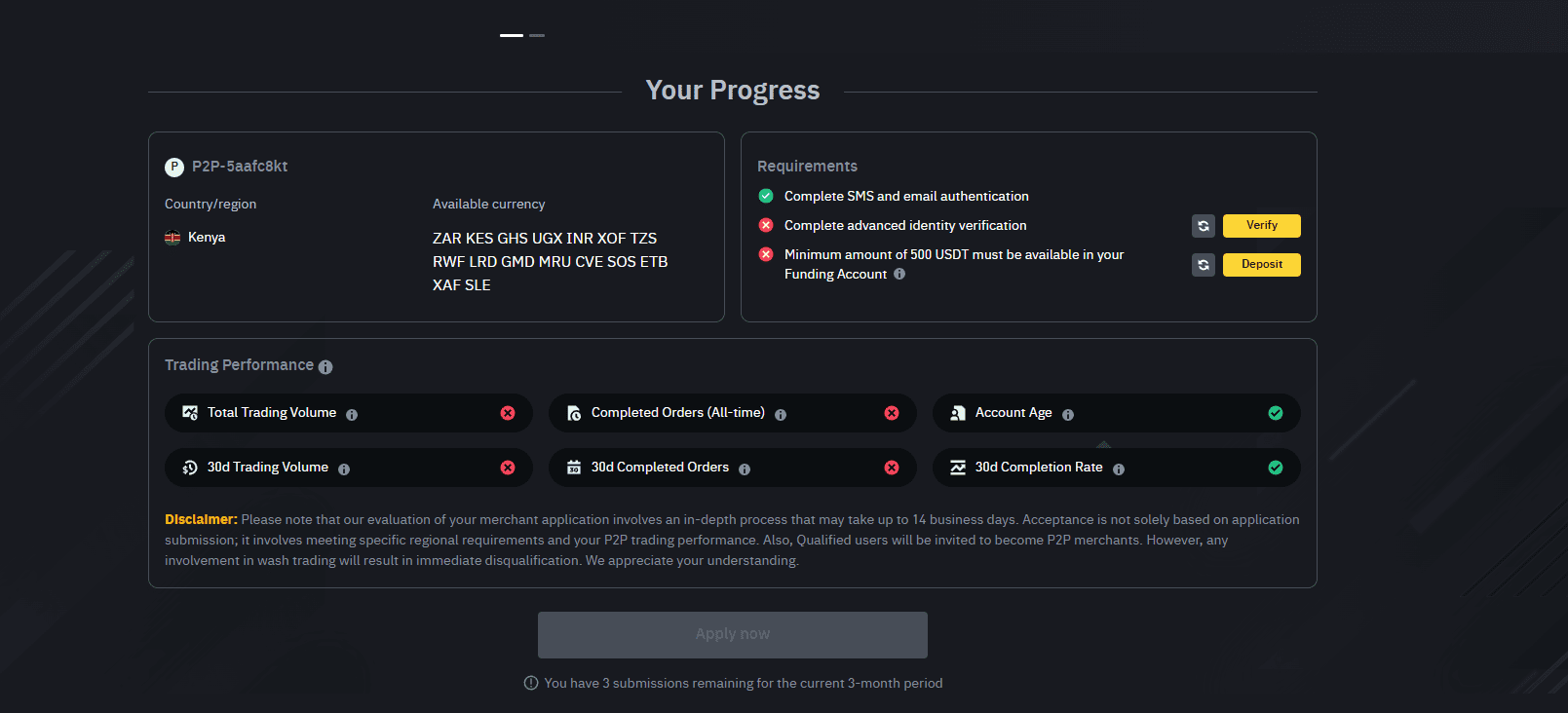

Binance P2P Requirements

While Binance P2P trading offers an excellent opportunity to generate consistent income, it’s crucial to understand that becoming a P2P merchant isn’t automatic. Binance has implemented several important safeguards and requirements that you’ll need to satisfy before you can fully leverage the platform’s potential.

These requirements serve a dual purpose: they protect the P2P ecosystem from fraudulent actors while also ensuring that merchants have sufficient experience and stake in the system to conduct transactions responsibly. Here’s what you’ll need to overcome to unlock your full earning potential:

Identity Verification (KYC Level 2): Binance requires all merchants to complete their Intermediate Verification process. This involves uploading clear photos of your government-issued identification (such as your Kenyan ID card or passport) and completing a facial verification check. This step is non-negotiable and helps maintain the integrity of the platform while complying with global regulatory standards.

Account Maturity: Your Binance account typically needs to be at least 30 days old before you can apply for merchant status. This waiting period allows Binance to monitor account behavior and establish a baseline of legitimate activity. New users should use this time to familiarize themselves with the platform and build up their trading history.

Trading Volume Prerequisites: Before becoming a merchant, you’ll likely need to demonstrate platform engagement through a minimum amount of spot trading activity. While Binance doesn’t publicly disclose the exact threshold, actively trading on the spot market for a few weeks usually satisfies this requirement. This experience is valuable anyway, as it helps you understand market dynamics better.

Security Deposit Requirement: To protect buyers and create accountability, merchants must place a security deposit in cryptocurrency (typically BTC or BUSD). This deposit serves as collateral that can be used to resolve disputes if necessary. As of our latest update, merchant deposits typically range from the equivalent of $500 to $2,000 USD in crypto, though this can vary based on your intended trading volume and account history.

Account Standing: Your Binance account must have a clean record with no history of violations, suspicious activities, or unresolved disputes. Even minor infractions can delay or prevent merchant approval, so maintain strict compliance with all platform rules from day one.

Mobile Verification: A verified mobile number is mandatory for merchant accounts. This provides an additional security layer and ensures Binance can reach you regarding important account updates or potential issues with trades.

Enhanced Security Protocols: Two-Factor Authentication (2FA) must be enabled on your account before you can become a merchant. This significantly reduces the risk of unauthorized access to your account, protecting both you and your trading partners.

These requirements might seem stringent, but they’re designed to create a secure and trustworthy trading environment. The merchant verification process typically takes several days to complete after you’ve submitted your application, so plan accordingly.

It’s worth noting that these requirements evolve over time as Binance refines its security measures and responds to regulatory changes in different markets. Always check the current application process on the official Binance website or app before developing your P2P trading strategy.

Starting Before Full Merchant Status

If you don’t yet qualify as a merchant or are waiting for approval, don’t be discouraged. You can still participate in the P2P ecosystem as a regular user by responding to existing offers rather than creating your own. While this approach has limitations on transaction volumes and frequency, it allows you to:

- Build your account history and reputation

- Learn the mechanics of P2P trading without the pressures of merchant responsibilities

- Begin making smaller profits while working toward full merchant status

- Develop relationships with established merchants in the Kenyan market

Many successful P2P traders started as regular users before transitioning to merchant status once they met all requirements. This gradual progression allows for a natural learning curve and reduces the risk of costly mistakes early in your trading journey.

Step-by-Step Guide to P2P Trading on Binance

Let me walk you through the exact process I use to make consistent profits on the Binance P2P platform. This guide works whether you’re using the Binance website on a computer or the mobile app, though I find the computer interface slightly easier for beginners to navigate.

Understanding the P2P Interface

Once you’ve accessed the P2P marketplace with KES as your currency, you’ll see two tabs:

- Buy: Shows offers from people selling crypto (you would be buying from them)

- Sell: Shows offers from people buying crypto (you would be selling to them)

For each cryptocurrency (BTC, ETH, USDT, etc.), you’ll see different prices being offered by various traders. The best opportunities arise when there’s a noticeable difference between the buying and selling prices.

Mastering the Art of P2P Order Creation

The heart of successful Binance P2P trading lies in creating strategic buy and sell orders that position you favorably within the marketplace. Let me walk you through how to craft these orders in a way that maximizes your profit potential while minimizing risk.

Creating Strategic Buy Orders

When aiming to purchase cryptocurrency at competitive rates (which you’ll later sell at a higher price), the process begins by navigating to the P2P interface and clicking on the three dots menu near the top of the screen. From there, select “Post New Ad” to begin crafting your purchase offer.

Your first crucial decision comes when selecting “I want to Buy” along with your preferred cryptocurrency. While Bitcoin (BTC) and Ethereum (ETH) are popular options, don’t overlook stablecoins like USDT which can offer more predictable arbitrage opportunities with less exposure to market volatility. After selecting your cryptocurrency, ensure you’ve set KES (Kenya Shillings) as your fiat currency.

Now comes an essential strategic choice: your pricing method. While the platform offers both “Fixed” and “Floating” price options, experienced traders overwhelmingly prefer the latter. With floating prices, your offer automatically adjusts based on current market conditions rather than remaining static. This dynamic adjustment provides crucial protection against market dips that could otherwise leave you overpaying for cryptocurrency when prices suddenly drop.

When setting up your floating price, you’ll work with a formula that multiplies the market price by your chosen exchange rate. This is where your competitive edge emerges. By setting your price margin slightly above market rate—say at 100.5%, representing a 0.5% premium—you’ll position your offer more attractively than competitors offering only market rate. Before finalizing this percentage, take a moment to scan current top buy offers and strategically position yours just above them to capture priority attention from sellers.

After clicking “Next,” you’ll specify your purchase amount. While the specific amount depends on your available capital, many Kenyan traders find success starting with modest amounts like 0.01 BTC and scaling up as they gain experience. Whatever amount you choose, ensure you have the equivalent KES readily available for quick transfers to sellers when trades are accepted.

Order limits represent another opportunity for strategic advantage. By setting a lower minimum (around 1,000 KES) and a reasonable maximum (perhaps 5,000 KES), you create opportunities for smaller traders who might have limited cryptocurrency to sell. This approach typically generates more frequent trading activity compared to only accepting larger transactions, allowing you to build reputation faster while turning over your capital more efficiently.

Next, configure your payment methods with M-Pesa as your primary option, given its overwhelming popularity in Kenya. Adding alternatives like Pay Bill or bank transfer options as secondary methods can broaden your potential trading partners. When setting your payment time limit, the 15-minute window has proven most effective. This shorter timeframe demonstrates your seriousness to counterparties while ensuring your capital doesn’t remain locked in pending transactions for extended periods.

Before finalizing your buy order, add clear, concise remarks with any specific instructions for sellers. These might include information about payment references or confirmation processes. Finally, refine your counterparty conditions to enhance security. While “Completed KYC” comes enabled by default, consider adding “Days from registration” and setting it to 5+ days to ensure you’re trading with established users who have demonstrated platform commitment.

With these settings optimized, click “Post” and confirm your ad details to make your offer visible in the marketplace.

Crafting Profitable Sell Orders

The selling process mirrors the buying workflow with some crucial strategic differences. Begin by following the same initial navigation path, but select “I want to Sell” instead. Before proceeding further, ensure your cryptocurrency is properly positioned in your Funding Wallet rather than your Spot Wallet—a common mistake that can delay your ability to complete transactions.

Your pricing strategy becomes even more critical when selling. Take time to analyze the current lowest sell offers, as these represent your competition for buyer attention. If the prevailing offers sit at 101.5% of market price, position yours slightly more attractively at perhaps 101.3% to appear higher in buyers’ search results. This small margin adjustment can dramatically increase your order fulfillment rate while still preserving your profit potential.

When setting up payment receipt methods, provide complete and accurate details for your M-Pesa account, carefully verifying the phone number to avoid misdirected payments. Many successful Kenyan traders also include bank account options for buyers who prefer traditional banking channels, particularly for larger transactions that might exceed M-Pesa limits.

Maintain the same disciplined approach to payment time limits on the selling side—15 minutes remains the sweet spot that balances transaction efficiency with reasonable buyer expectations. This consistency across your buying and selling operations creates a professional trading presence that builds trust with counterparties.

After completing your sell order setup and posting it to the marketplace, remain vigilant and responsive to incoming purchase requests. Swift communication and transaction processing not only lead to positive reviews but also enable you to complete more trades daily, bringing you closer to that 3,000 KES daily income target.

The Arbitrage Strategy in Action

Here’s how the complete arbitrage strategy works in practice:

- Create a buy order with a competitive rate (e.g., 100.5% of market price)

- When someone sells to you, you receive the cryptocurrency in your Funding Wallet

- Immediately create a sell order at a higher rate (e.g., 101.3% of market price)

- When someone buys from you, you transfer the cryptocurrency and receive payment

- Your profit is the difference between your buy and sell rates

For example, if you buy Ethereum at 219,900 KES and sell at 220,400 KES, you make 500 KES profit per Ethereum. Complete multiple trades per day, and you can easily reach the target of 3,000 KES daily profit.

Pro Tips for Successful P2P Trading in Kenya

Stay Competitive: Position your offers among the top listings by offering slightly better rates than competitors. Being at the top of the list significantly increases your chances of completing trades.

Monitor the Market: Crypto prices fluctuate constantly. What was profitable an hour ago might not be profitable now. Regularly check and adjust your orders to maintain competitiveness.

Start Small: Begin with smaller amounts until you’re comfortable with the process. As you gain confidence and experience, gradually increase your trading volumes.

Use M-Pesa Primarily: Most Kenyan traders prefer M-Pesa for its convenience and speed. Having this as your primary payment method will attract more traders.

Response Time Matters: Quick responses to trade requests lead to more completed trades and better reviews. Set notifications for trade alerts and try to respond promptly.

Check Trader Reputation: When trading with others, check their completion rate and number of trades. Higher numbers generally indicate more reliable trading partners.

Keep Records: Track all your trades, profits, and losses for tax purposes and to analyze your performance over time.

Risk Management

While P2P trading offers excellent profit opportunities, it’s important to manage risks:

- Only trade with amounts you can afford to have tied up in transactions

- Be cautious with new users who have little or no trading history

- Double-check payment details before confirming transactions

- Start with smaller trades to build your confidence and reputation

Important Factors to Consider Before Joining Binance P2P

Regulatory Environment

Cryptocurrency regulations in Kenya are still evolving. While P2P trading itself is not explicitly prohibited, stay informed about any regulatory changes from the Central Bank of Kenya and other financial authorities. Trading through P2P platforms might offer some insulation from regulatory changes that affect centralized exchanges, but it’s important to remain compliant with all local laws.

Capital Requirements

While you can start with modest amounts, having adequate capital will significantly impact your earning potential:

- Consider starting with at least 10,000-50,000 KES to make the potential profits worthwhile

- Remember that your capital will be temporarily locked during trade processing

- Factor in the need to maintain competitive offers, which requires sufficient funds

Technical Requirements

Ensure you have:

- Reliable internet connection to respond promptly to trade requests

- A smartphone or computer that can access the Binance platform smoothly

- Backup power solutions if you’re in an area with inconsistent electricity

- Multiple payment options set up (M-Pesa, bank accounts, etc.)

Time Commitment

P2P trading requires active management:

- You’ll need to monitor the platform regularly to keep offers competitive

- Response time is critical – delayed responses can result in canceled trades and poor reviews

- Consider if you can dedicate several hours daily, especially during peak trading periods

- Building a reputation initially requires more time investment

Risk Tolerance

Understand the various risks involved:

- Counterparty risk – some traders might attempt to defraud you

- Price volatility – cryptocurrency values can change rapidly during trades

- Payment disputes – be prepared to handle issues with payment confirmations

- Account security – your Binance account must be properly secured

Security Measures

Before starting, implement proper security:

- Enable two-factor authentication (2FA) on your Binance account

- Use strong, unique passwords

- Be vigilant about phishing attempts

- Keep a portion of your crypto in cold storage if accumulating larger amounts

Exit Strategy

Have a clear plan for:

- Converting profits to fiat currency regularly

- What you’ll do if market conditions become unfavorable

- How you’ll handle potential regulatory changes

Join Our Crypto Trading Training Program

Want to master these strategies and more? Our comprehensive crypto trading program for Kenyan traders covers:

- Advanced P2P trading techniques beyond what’s covered in this guide

- Futures trading (as detailed in our previous 2,000 KES daily method)

- Risk management strategies specific to the Kenyan market

- Tax considerations for Kenyan crypto traders

- One-on-one mentorship with experienced Kenyan traders

Conclusion

P2P trading on Binance offers an excellent opportunity for Kenyans to generate daily income with relatively low risk. By understanding price differences and positioning yourself strategically in the marketplace, you can consistently earn 3,000 KES or more per day, depending on your trading capital and market conditions.

The beauty of this method is its simplicity – you don’t need complex trading skills or technical analysis knowledge. You simply need to understand how to spot price differences and act quickly to capitalize on them.

As you gain experience and confidence, you can gradually increase your trading volume, diversify into different cryptocurrencies, and potentially increase your daily profits significantly beyond the 3,000 KES target.

FAQ

- What is Binance P2P?

Binance P2P is a peer-to-peer marketplace where users can buy and sell cryptocurrencies directly with other users using local fiat currencies. Unlike regular crypto exchanges where you trade against the order book, P2P trading connects you directly with counterparties, offers more payment methods, and often allows trading in local currencies. - How secure is trading on Binance P2P?

Binance P2P incorporates several security measures including an escrow service that holds the cryptocurrency until both parties confirm the transaction is complete, identity verification requirements, user reputation systems, and dispute resolution mechanisms. However, users should still exercise caution and only use approved payment methods to minimize risks. - What payment methods can I use on Binance P2P in Kenya?

Binance P2P supports various payment methods in Kenya, but the most used one is M-Pesa. This allows the merchant to send funds directly into your mobile wallet in minutes. - Are there fees for using Binance P2P?

Binance P2P typically doesn’t charge fees to buyers. Sellers pay a small fee (often around 0.1%) when their orders are successfully completed. The platform is generally more cost-effective than traditional exchanges for fiat-to-crypto conversions, especially in regions with limited banking options for crypto.