At a glance about Scope Markets

[table id=2 /]Introduction

Would you like to use Scope Markets, but you are uncertain about some factors? Would you like to know the credibility of Scope Markets as a trading platform?

In this scope markets review, we are going to give an unbiased opinion about the credibility of Scope Markets Kenya.

Let us explore the trading platform while considering its fees, security level, and other vital aspects.

What is Scope Markets?

Before we get into our scope markets review, it is important to briefly introduce the company. Scope Markets Kenya is an electronic brokerage firm that helps investors buy and sell stocks, bonds, other securities.

The Scope Markets trading platform has been in existence since 2014, and many people use it as their ideal trading platform. Scope Markets have good return offerings, and since they are STP brokers, clients have zero conflict of interest with intermediaries.

Scope Markets provides a platform for people who want to trade in the stock market but don’t have access or time to do it themselves. They can invest their money with Scope Market’s expert traders at any given moment on things like Apple shares instead of spending hours researching individual companies while working full-time jobs

In 2019, Scope Markets was licensed and regulated by the CMA, and it operates as SCFM Limited. Scope Markets is considered a secure forex broker because it is not only locally regulated but it is also regulated by two international licensing bodies; CySEC and FSCA.

Due to local regulation, Scope Markets Kenya is considered a low-risk trading platform, and it also segregates client funds from the main trading funds. It makes it easy for clients to access their money anywhere, anytime.

Scope Markets Review: Account Types and Spreads

Scope Markets Kenya has two types of accounts; The Gold and Silver accounts.

The Gold account is an ECN type of account with a low spread that starts from 0.2 pips, and it offers a $7 commission per lot.

The Scope Markets Kenya silver account does not offer any commissions, and the only applicable fee is the variable spread for every lot. Both accounts require a minimum deposit of $20, and they offer negative balance protection only when a client places a request.

The next part of this Scope Markets review breaks down the trading and non –trading fee incurred when using the trading platform.

a) Their spreads are not too high, but not the lowest: The Silver account has a variable spread. For instance, major currency pairs like the EURUSD range from 1.1 to 2 pips. This is a relatively similar spread to FX pesa, but it is much higher than XM OR FXTM. 0758721550

b) The Golden account offers commissions: Scope Markets charges a $7 commission for every standard lot on the Gold account. The spread on the Gold account is much lower than the Silver account, and it is ideal for use by high-volume traders.

c) Scope Markets has no deposit and withdrawal fees: Every transaction, including M-Pesa withdrawals and deposits are free.

d) Inactive accounts are not charged: Dormant accounts are not subjected to any fees. One can log back in and start trading at no cost.

Scope Markets Review: Instruments and Currencies Offered

From their official website, Scope Markets Kenya have a limited number of trading instruments. They offer only 63 trading instruments listed below.

-44 currency pairs- the seven major currency pairs are included

-CFDs on 14 indices

-2 metals

-3 energies

If you would like to trade major currencies, Scope Markets Kenya is a viable option.

For minor and exotic currency pairs, it would be best to find another broker.

What people say about Scope Markets (Scope Markets Reviews on Facebook and Google)

From the Scope Market reviews on Google, most users are complimenting the fast deposit and withdrawal services. Most reviews say that transactions are processed instantly, which makes Scope Markets convenient. They also agree that Scope Markets has tight spreads, which are helping them make more profits.

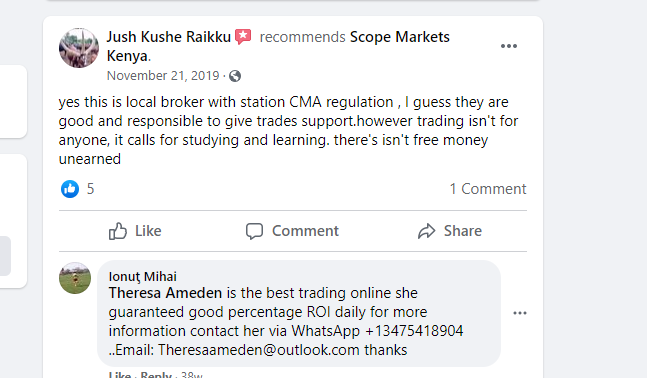

From Facebook Scope Market Kenya reviews, users agree that Scope Markets is trustworthy, especially since the CMA regulates it. However, some users are cautioning others about believing in free forex money.

They say that trading is not for anyone, and before profits can be realized, a lot of learning is required.

Here is a sample of scope markets reviews from google;

Here is a sample of reviews from their official facebook page;

Scope Markets Review: Customer Support and Client Related Feedback

The Scope Market’s customer service system is one of the best. Scope Markets has multi-lingual customer service personnel who work round the clock to attend to clients globally. They can be contacted through contact numbers and support service emails provided on their website.

In addition, Scope Markets Kenya has a physical office located in Westside Tower, 4th Floor, Office no. 402 &403, along Lower Kabete Road, Westlands, Nairobi.

From the clients’ feedback on Google, Scope Markets has a fast and reliable customer care system, which promptly responds to clients and offers useful assistance.

Is Scope Markets an ECN Broker?

Scope Markets is a hybrid broker; it combines both STP and ECN brokerage. The Silver account package is an STP broker account, while the Gold option is an ECN broker account. It implies that the Silver account uses a liquidity broker who does not raise conflicts of interest, while the Gold account allows direct acces to the real international currency market.

Is Scope Markets Regulated?

As mentioned above, Scope Markets Kenya is regulated by three regulatory bodies; one local, and two top-tier international regulators. The Capital Markets Authority (CMA) is the Kenyan regulator for Scope under license number 123.

Scope Markets Kenya was the second non-dealing desk forex broker to be authorized in Kenya.

FCSA licensed Scope Markets’ operations in 2016, with FSP number 47025. CySEC began regulating Scope Markets in 2017, under license number 339/17.

How do you Open a Scope Markets Account?

Opening an account is quite easy with scope Markets Kenya, just that national documents are part of the requirement. Here are the steps

- Complete the sign-up form found on their website

- Submit a copy of your national id, and a copy of your KRA pin certificate.

- Wait Verification within 24 hours

- Start trading

How do you Deposit Money into Scope Markets?

Depositing money on Scope Markets is easy. All you need to do is;

- Log into your Scope Markets account and click the wallet button on the display panel

- Afterward, navigate to the deposits section on the portal and choose your preferred deposit account.

- Once you have made this selection, you will be guided on filling in your details, and once they are submitted, your payment’s processing begins.

When the transaction is completed, your deposit will instantly reflect on your account.

Scope Markets Minimum Deposit

The scope markets minimum deposit for both the Gold and Silver accounts is $20, or KES 2,000. Different account types have different minimum deposits in most trading platforms, but Scope Markets are different.

Scope Markets makes it easy for every trader to make large profit margins. One must carefully choose between the Golden and Silver accounts depending on what they intend to achieve in the long run. You can learn more about scope markets minimum deposit from their main website www.scopemarkets.com.

Scope Markets Withdrawal

The minimum amount you can withdraw from a Scope Markets account is 50 units of the following currencies: USD, EUR and GDP. For example, if you are dealing in dollars, the minimum amount you can withdraw is 50 USD. Scope Markets Withdrawal policy provides for a limited number of free withdrawals. Per day, you can withdraw money once for free. In a week, you are allowed a maximum of 5 free scope markets withdrawals.

Scope Markets Account Types

Scope Markets have Silver and Gold Accounts. These accounts offer the same functionality when it comes to trade strategies allowed, swap free option, leverage and minimum trade size. Both accounts have a margin call of 100% and a stop out level of 50%.

The differences in the gold and silver scope markets account types are in the spread and commission. For the silver account, the spread when trading EURUSD is 1.1 pips. For the gold account, the spread when trading the same currency is 0.2 pips.

The gold account offers a commission of $3.5 per side but the silver account offers no commission at all. Clearly the scope markets gold account is the best.

Scope Markets Signup

For a successful scope markets signup, you only need to upload your valid personal documents and put money into your account. The minimum deposit while opening an account is $250. With these two requirements in place, you just register your account and start trading in no time.

How do you Withdraw from Scope Markets?

Withdrawing from Scope Markets is as easy as making a deposit. After confirming that there are funds in your Scope market account which can be withdrawn, click on the wallet option in your account. Select the ‘withdraw’ option on the portal. Select your preferred payment method and complete your request.

Withdrawals can be instant or may take 24 hours to be processed, depending on the selected payment method. Scope Markets support funding methods like Airtel Money, Equitel, M-Pesa, MasterCard, Pesalink, Visa, Skrill, and Neteller.

How do I Trade with Scope Markets in Kenya?

Trading on Scope Markets Kenya can be done using the following simple steps.

Step 1. Registration

Open a Scope markets trading account as a new or experienced trader. Fill in the sign-up form with your details and submit it.

Step 2. Verification

Submit a copy of your national Id and KRA pin, which will be verified for compliance.

Step 3. Fund your account

Using your preferred payment method, deposit funds into your Scope Markets account.

Step 4. Trade

Start trading your favorite currency pairs, indices, commodities, and shares on the Scope Markets platform.

Final Verdict on Scope Markets: Is Scope Markets a Good broker?

This Scopes Market Kenya review validates the Scopes Market trading platform. Since the CMA and top-tier regulators regulate them, they can be trusted. Their account types are clear, and they spell out the differences between both.

The minimum deposit required is fair and standard. Scopes market Kenya accepts local payment methods like bank transfers and M-Pesa deposits and withdrawals.

On the other hand, Scope Markets Kenya have a limited number of trading instruments, and they only offer the MT5 trading platform. If you are familiar with MT4 or the cTrader platforms, Scope Markets Kenya does not favor you.

Generally, Scope Markets Kenya has a lot of room for improvements, but if you are looking to trade major currency pairs, they are one of your best shots, and they are trustworthy due to regulation by the CMA.

Other Frequently Asked Questions

Some of the frequently asked questions in most Scopes markets Kenya reviews are listed and answered below.

i) Is Scope markets a legitimate forex broker in Kenya?

Is scope markets legit? This is a common question amongst Kenyan forex traders.

Yes, Scope markets is a legitimate forex broker in Kenya, and it is licensed by the CMA. It is also licensed by top-tier regulators; CySEC and FCSA.

ii) Does Scope markets accept M-Pesa payments?

Yes, Kenyan traders can use M-Pesa to deposit and withdraw money from Scope markets. All M-Pesa transactions are processed within a few hours. Besides M-Pesa, local bank transfers can also be used to transfer money.

Also read: Brokers that accept Mpesa in Kenya

iii) What is the minimum deposit required for both Gold and Silver accounts?

Scope markets minimum deposit required by both accounts is $20, or 2,000 Kenya shillings.

Final Verdict Summary on a scale of 1-5

Overall rating 4.6

Safety and security 4.7

Trading instruments 3

Fees 4.2

Account opening 4.0

Scope Markets is a trading platform that has been around for two years.

From this scope markets review, it’s easy to see why it would be so popular in Kenya, where many people are interested in investing their money.

The security of the website and its fees make this site an attractive option for those looking to trade stocks in Kenya.

Click here if you want to sign up with scope markets as a trading platform!